How To Plan A Wedding After Demonetisation ?

Lately the papers are flooded with news and updates about demonetisation. While the debate goes on about the pros and cons on this matter; one can’t disagree with the fact that the unexpected abolition of high value bills has had a significant impact on our lives, especially for those who had planned to get married in coming months.

The wedding industry in India is larger than life, yet it is also highly unorganized. To pull off an Indian wedding you need cash for majority of transactions, this includes grocery bills, florist, caterers and tent vendor’s payments etc.

Now that all old currency is of no value, wedding planning needs a novel approach, here are a few nifty ways to plan your wedding smartly:

1# The 2.5 lakh blessing!

The Reserve Bank of India has allowed withdrawal of Rs 2.5 lakh by one person per family, who have a wedding planned before 30th December, 2016.

To withdraw the aforesaid amount, applicants need to submit following documents:

- Proof of wedding, by means of wedding invitation card.

- Complete list of vendors to whom payments are to be made. Also, need to attach a declaration from vendors attesting that they don’t own a bank account.

- In case any advance payments have been made, applicant must attach a copy of the receipts.

2# Go the cheque way

Whenever possible go the cashless way. While it’s true that most people will expect you to pay in cash like caterers, flower vendors etc, however, you can’t pay everyone in cash. The best way out is to pay via cheques or via online transfers.

3# Prioritize your expenses

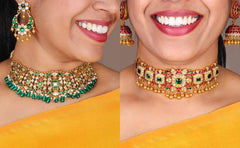

Let’s be honest, when we get into the wedding mode we tend to get a bit extravagant with the venue, food, drinks and the LEHENGAS! With demonetisation limiting your expenses why not prioritize your expenses? Instead of spending a fortune on the venue go for an eccentric venue like a building rooftop, a friend or family member’s backyard or home. That’s not all, if you are prioritizing your expenditure on jewelry why not save a buck or two on the dress by trying the option of borrowing or renting the wedding lehenga.

4# Be Practical

For all the brides who absolutely hated tip no ‘3#’ (I knew I had it coming with the LEHENGA thing), look at the big picture a month from now, the pricey lehenga choli won’t matter as much. Instead, if you spend the saved money on a fancy honeymoon (paid through a credit card of course) won’t that be wonderful?

5# Cutting back is not so bad

Don’t be troubled if you have to curtail those expensive gifts, or if you have to cut down your guest list. As Stephen Covey very rightly said - "The main thing is to keep the main thing the main thing." To keep up the same spirit, focus on the main thing which is to make this day memorable for the bride and groom. Also, don’t forget that for every buck you spend, you have to show a source of earning.

6# How about a DIY wedding?

If you can’t compromise with your venue, jewelry or your lehenga (yes, I am back on that!) the smartest way left for you to pull off a wedding amidst demonetisation is to go for a DIY Wedding. There are lots of DIY ideas that can help you save plenty, take help of from your friends and cousins and engage everyone in preparing DIY invites, floral decorations and wedding favors. Not only does DIY add a personal touch to your wedding décor; it also reduces your decoration budget by nearly 20%.

Long story short:

Don’t let demonetisation bring you down; instead use it as an opportunity to save some money. Have a small wedding and keep the guest list even smaller. There’s no need to invite the whole city to the ceremony, besides you have the perfect excuse to leave a few names out – God bless demo demonetisation!